See exactly how to take advantage of the next bull market.

It hasn’t been an easy year for investors, and with fears of a looming recession many are worried about what it means for their money.

While no one can say how the market will fare in the coming months, it is certain that a bull market is on the way. Every bear market in history has given way to a bull market, and this one will be no different.

That might not be very reassuring while stocks are still down, but now is the time to start preparing for the inevitable rally. See how the smartest investors prepare.

1. Avoid trying to time the market

In an ideal world, the best way to make money in the market would be to invest only when prices are at their bottom and then sell when they peak.

However, in the real world, the stock market can be unpredictable. No one—not even the experts—knows exactly when stock prices will bottom out.

In that case, it’s best to invest consistently rather than trying to time the market. You can buy now just to drive stock prices down in the future, but it’s better than waiting too long and investing after prices go up.

Legendary investor Peter Lynch put it this way in a 2003 interview with Money Magazine: “My system for over 30 years has been this: When stocks are attractive, you buy them. Of course, they can go lower. a $12 share that went to $2 but then went to $30.

2. Keep a long-term view

Nobody knows exactly how long it will take for the market to recover. Some bear markets bottom after just a few months, while others last for over a year. But it will eventually recover.

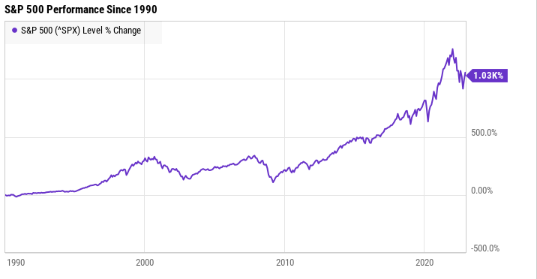

The best thing you can do in the meantime is be patient. If stocks drop again, try not to panic and instead focus on the longer term. The market itself has faced dozens of corrections, bear markets and recessions over the years, but has recovered from them all.

Given enough time, he too will bounce back from that drop. If you stay in the market for the long term, you will reap the rewards during the inevitable recovery.

In the words of John Bogle, founder of Vanguard and one of the most successful investors of all time: “Time is your friend. Momentum is your enemy.”

3. Don’t wait too long to invest

When stock prices are falling, it’s tempting to put off investing until the market looks a little more promising. But then again, effective market timing is next to impossible. If you wait too long to buy, you could miss out on significant gains.

In 2008, Warren Buffett wrote an op-ed for The New York Times. “I cannot predict short-term stock market movements,” he wrote. “However, the market is likely to go up, perhaps long before sentiment or the economy improves. So if you wait for the thrushes, spring will be over.”

It can be an intimidating time to invest, but now is one of the best buying opportunities of the year. By investing now, ignoring the momentum of timing the market and staying in the market for the long haul, you can make the most of the next bull market.

Something big just happened

When our analysis team has an investment tip, it pays to hear it. After all, the newsletter they’ve run for over a decade, Motley Fool Stock Advisor, has tripled the market.